Why Gaming Companies are betting on Blockchain for the future of Gaming

The gaming industry has seen a surge in the number of blockchained-based games that has created a new experience for both businesses and players. Blockchain games have

Here at genesis.studio, we foster a culture of learning, helping our employees to accomplish their goals and to grow their personal skills in the financial world. But we realized that you deserve to be informed about these subjects as well so, in order to help you acquire more information about investments and finances, we would like to share the content that the speaker Carlos Simões, our Innovation & Solutions Manager, in partnership with our Marketing Director, Miguel Pinto Ferreira, shared with us.

In an increasingly unstable world scenario, with the covid-19 pandemic and, now, with the situation of war, inflation rates are expected to rise globally and, consequently, a reduction in the purchasing power of the population.

In line with the previous thought, what is the best way to tackle this problem, fighting inflation and promoting the subsistence of our purchasing power? To answer this question, and in line with the theme that will be approached in this article, investing the capital that you can put aside every month instead of saving it, is the most acceptable solution for solving this problem, and here’s why:

The concept of saving presupposes a mechanism for gathering money that an individual doesn´t have the need to spend, storing that money and obtaining a sense of financial freedom. But, what most people don´t understand, is that their money is depreciating day by day, as global inflation rates are increasing, reducing their purchasing power. In fact, what you can buy with €10 now, you won’t be able to buy it 10 years from now. We could then assume that “saving” is, inadvertently, losing money. So, how can we allocate our money so that it follows the rise in inflation rates, maintaining or even increasing, over time, our ability to purchase products or services? The most accepted answer is: investing.

When talking about investments, most people feel insecurities and doubts, since there is some volatility in the financial markets, fearing to lose all the capital they have allocated in their investments. Therefore, there is a “magic word” that will reduce this investment risk: Diversification.

A diversified investment portfolio is a very important concept in reducing investment risk, and a topic deeply studied by the renowned American investor and billionaire Raymond Dalio, who argues that a diversified investment portfolio not only reduces the associated risk but can also maintain or even increase the expected result. We advise you to watch the following video produced, in the first person, by Raymond Dalio, in which he deeply explains this topic: https://www.youtube.com/watch?v=Nu4lHaSh7D4

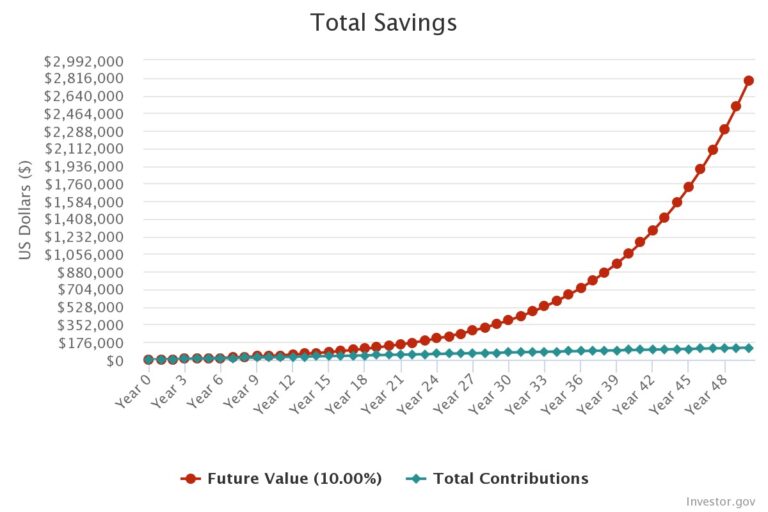

The concept of compound interests has a lot of predominances when it comes to investments, being classified by Albert Einstein as the “eighth wonder of the world”. Compound interests are interests received through its calculation of the principal amount, including interest accrued from previous periods of a deposit or loan, constituting advantages over simple interests, as the final amount will be greater since the remuneration will be made by accumulating balances and interests. Thus, we believe that having a percentage of our portfolio allocated to composite assets, such as the S&P500 index, is an investment advantage. Below, is a table that represents the accumulation of capital over 50 years, in a composite index (10%), with 0 initial investment and 200$ monthly contribution:

With the concepts discussed in this article, we truly believe that the main way to fight the rise in inflation rates and promote the continuity of our purchasing power, is through investment and not through savings. There is always a risk associated with investing but having a diversified investment portfolio is an extremely important factor in reducing exposure to market volatility and, finally, having a percentage of our portfolio allocated to compound interest investments is an excellent way to maximize the return on investment.

If you want to join a company whose culture focuses on personal and professional development, addressing topics such as financial literacy and helping its employees to succeed, you can apply to work with us, see all jobs available or send us an email!

The gaming industry has seen a surge in the number of blockchained-based games that has created a new experience for both businesses and players. Blockchain games have

Today we published the most recent gen.talks, our podcast series, where we partnered with PHC Software to discuss how companies can create the best work

Many people from different backgrounds are shifting to tech these days. The reason? There is a huge demand from technology companies and a great shortage